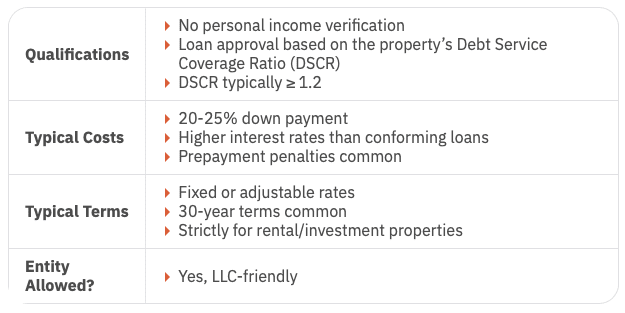

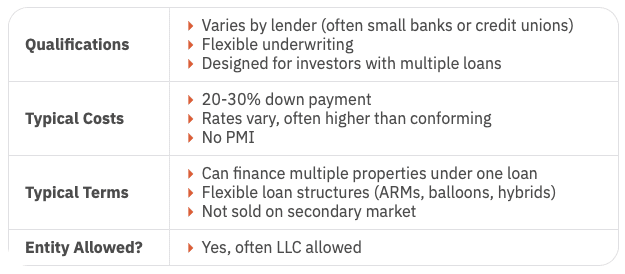

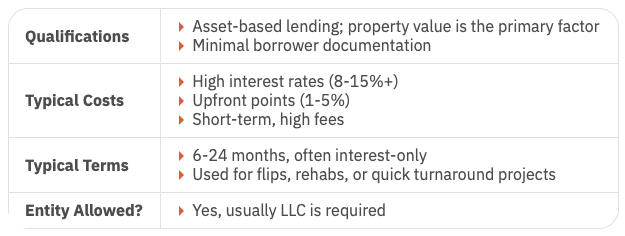

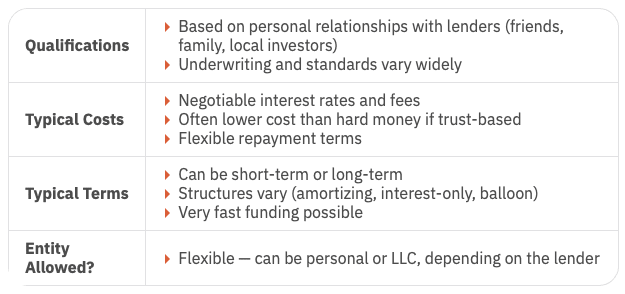

Explore the types of loans for investment property from conventional to hard money and discover which ones fit different investor strategies. Whether you’re a seasoned pro or just getting started, it’s always smart to step back and review the lending landscape. The financing you choose doesn’t just fund your deals; it shapes how you see the market, measure returns, and evaluate opportunities.

Explore the types of loans for investment property from conventional to hard money and discover which ones fit different investor strategies. Whether you’re a seasoned pro or just getting started, it’s always smart to step back and review the lending landscape. The financing you choose doesn’t just fund your deals; it shapes how you see the market, measure returns, and evaluate opportunities.